oklahoma franchise tax phone number

Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on forms filed with the Oklahoma Tax. File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S.

Oklahoma Tax Commission Facebook

Your message has been sent.

. Oklahoma Tax Commission PO Box 26850 Oklahoma City OK 73126-0850 This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to. The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in Oklahoma. Sales Tax Permit.

The request for your FEIN is authorized by Section 405 Title 42 of the United States Code. To make this election file Form 200-F. Our mailing addresses are grouped by topic.

It will be used to establish your identity for tax purposes only. Sales and Use Tax. Oklahoma levies a franchise tax on all corporations or associations doing business in the state.

Oklahoma Employer Account Number and Tax Rate. The Oklahoma Tax Commission can be reached at 405 521-3160. Your account ID is a three-letter account type indicator followed by a ten-digit number assigned by the Oklahoma Tax Commission OTC.

The report and tax will be delinquent if not paid on or before August 31. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives.

Corporations are taxed 125 for each 1000 of capital invested or otherwise used in Oklahoma up to a maximum levy of 20000 foreign corporations are assessed an additional 100 per year. Individual Income Tax Balance Due. Oklahoma secretary of state 2300 n.

Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on forms filed with the. Local Phone Sales Tax Department. Give Us a Call.

Estimated Return EOklahoma F. You will need to contact the Oklahoma Tax Commission Help Desk at 405521-3160 to have your online access reinstated. Federal Employer Identification Number FEIN.

Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at 405 521-3160. Due is income tax franchise tax or both. In oklahoma the maximum amount of franchise tax a corporation can pay is 20000.

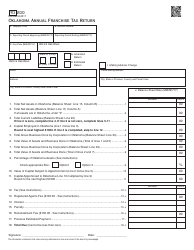

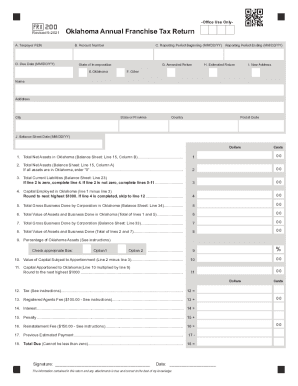

Revised 9-2021 Oklahoma Annual Franchise Tax Return FRX200-Office Use Only-State of Incorporation G. Oklahoma City OK 73126-0850. Oklahoma Tax Commission with each report submitted.

Individual filers completing Form 511 or 511NR should use Form 511-V. Oklahoma Franchise Tax is due and payable July 1st of each year. 911 Emergency ServiceEqualization Surcharge.

In Oklahoma the maximum amount of franchise tax a. If you already have a Withholding Tax Account ID you can find this number on correspondence from the Oklahoma Tax Commission. Please put your FEIN on your check.

Oklahoma Tax Commission Franchise Tax Post Office Box 26920 Oklahoma City OK 73126-0920 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identi-fication numbers is required on forms filed with the Oklahoma Tax Com-mission pursuant to Title 68 of the Oklahoma Statutes and regulations. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return. For additional assistance please contact the agency at 405-521-3160.

Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor. The franchise tax applies solely to corporations with capital of 201000 or more. The franchise tax applies solely to corporations with capital of 201000 or more.

These elections must be made by. Click here to return to home page. Electronic Reporting and Webfile Technical Support.

Oklahoma Tax Commission Payment Center. Oklahoma secretary of state 2300 n. Toll Free Phone Sales Tax Department.

EF-V 2 0 2 FORM 0 Address City State ZIP Daytime Phone Number Federal Employer Identification Number Balance Due Amount of Payment Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890 Do not enclose a copy of. Rural Electric Co-Op License. Thank you for contacting us.

If you are a new business register online with the Oklahoma Employer Security Commission to retrieve. Home Address street and number Daytime Phone area code and number City State or Province Country Postal Code Title 2. 540 540 2ez 540nr schedule x.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. While all corporations must file a report with the. First Name Middle Initial Last Name Social Security Number.

The in-state toll free number. Eligible entities are required to annually remit the franchise tax. State Services Local Services About PayOnline.

Eligible entities are required to annually remit the franchise tax. You MUST provide this information. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor.

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

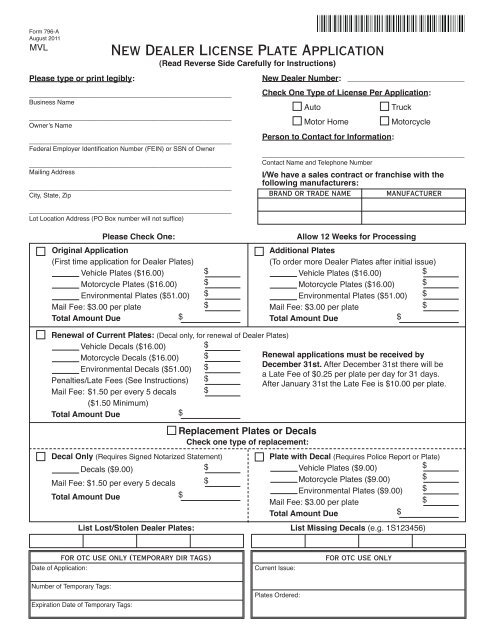

New Dealer License Plate Application Oklahoma Tax Commission

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Start A Nonprofit In Oklahoma Fast Online Filings

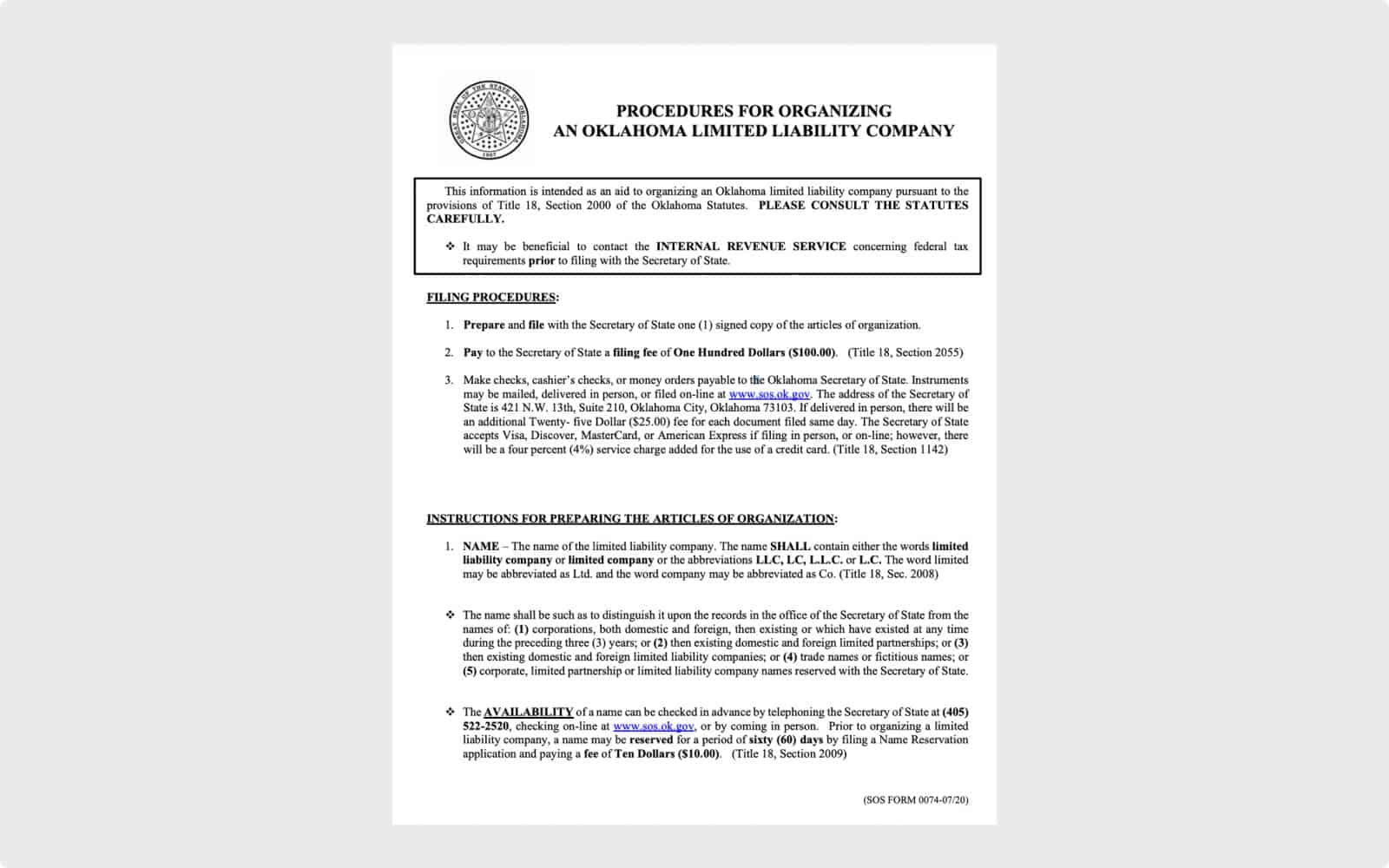

Costs Fees To Form And Operate An Llc In Oklahoma Simplifyllc

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Incorporate In Oklahoma Do Business The Right Way

Incorporate In Oklahoma Do Business The Right Way

Oklahoma Taxpayer Access Point

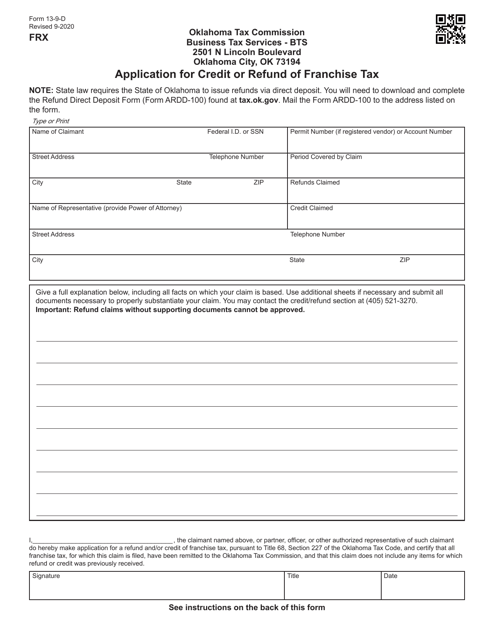

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Get And Sign Income And Franchise Tax Forms And Instructions Oklahoma 2021 2022

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 Oklahoma Templateroller